Will Insurance Pay for IVF After Tubal Ligation?

If you’ve had a tubal ligation—often called “getting your tubes tied”—and now find yourself dreaming of growing your family, you’re not alone. Life changes, hearts shift, and suddenly, the idea of another baby feels right. For many women in this situation, in vitro fertilization (IVF) becomes a beacon of hope. It’s a way to bypass those tied tubes and make pregnancy possible again. But here’s the big question on your mind: Will insurance cover IVF after a tubal ligation?

The short answer? It’s complicated. Insurance coverage for IVF is a maze of rules, exceptions, and state laws—and having a prior tubal ligation adds an extra twist. Don’t worry, though. This article is your guide. We’ll walk through what insurance companies typically do, why they might say no, and how you can figure out your options. Plus, we’ll dig into some fresh angles—like new state laws, real-life stories, and practical tips—that you won’t find in most other articles. Let’s dive in.

Understanding Tubal Ligation and IVF: The Basics

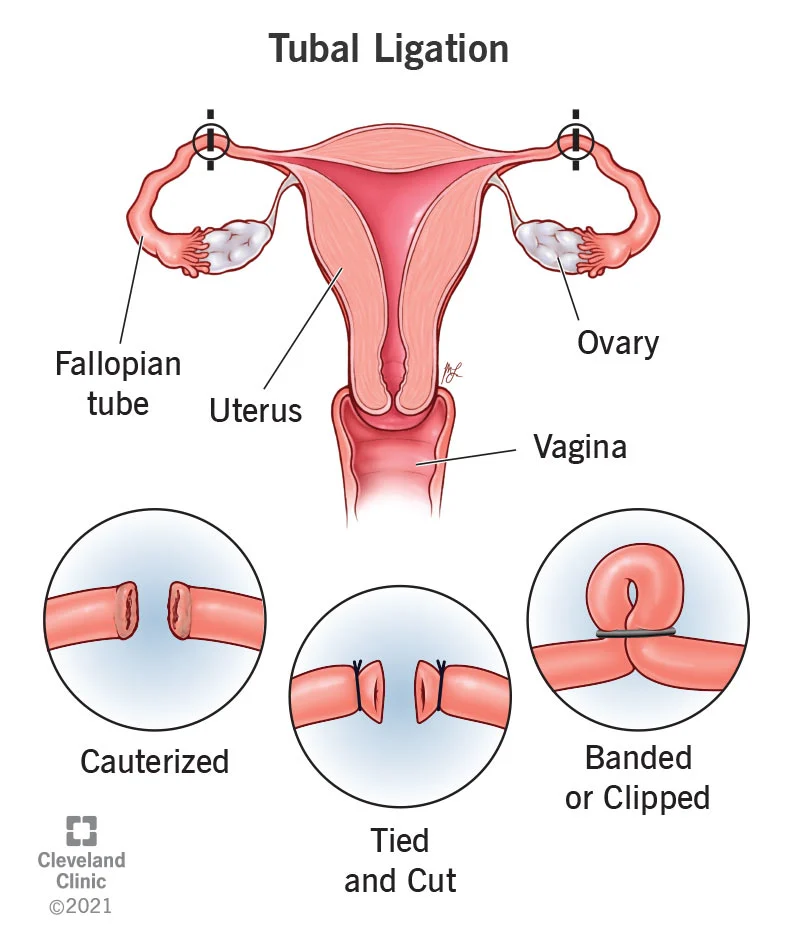

Tubal ligation is a surgery that closes off your fallopian tubes, stopping eggs from meeting sperm. It’s a popular choice for women who feel done having kids—about 600,000 women in the U.S. get it every year. But life isn’t set in stone. Maybe you’ve remarried, lost a child, or just had a change of heart. Whatever the reason, you’re now wondering about pregnancy after this “permanent” step.

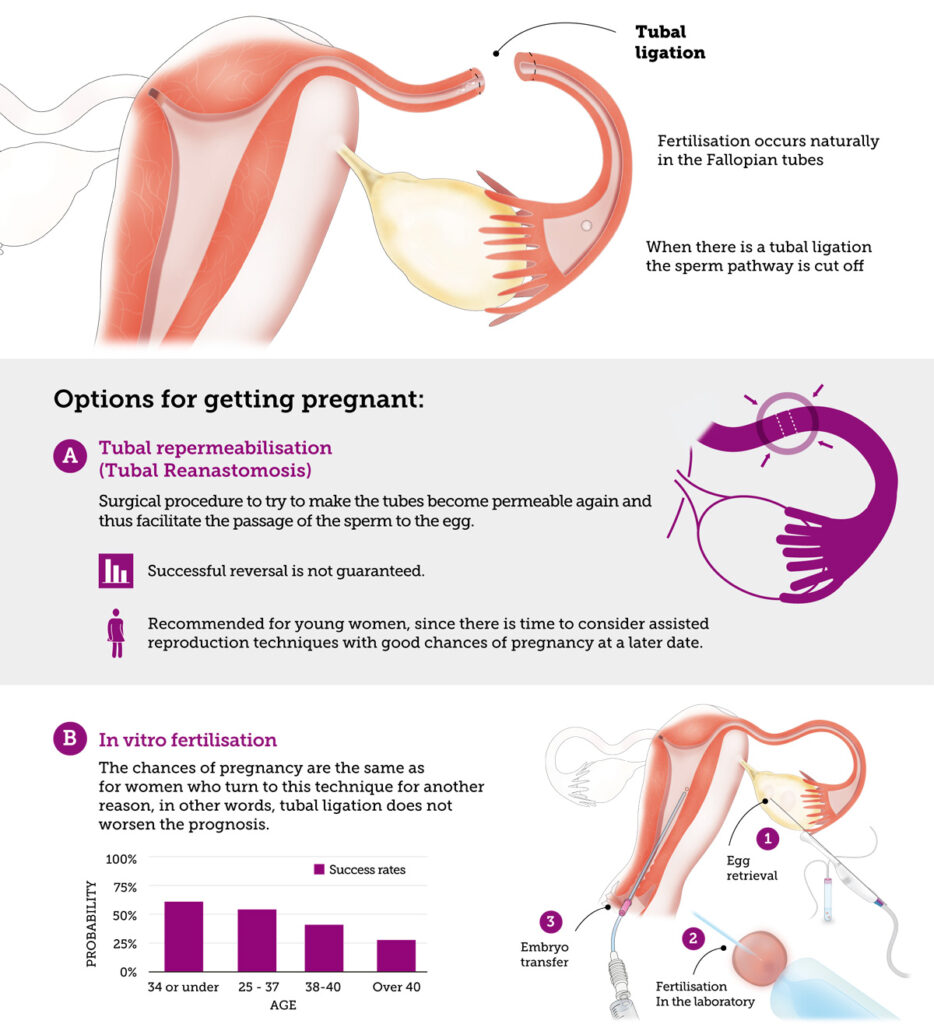

IVF offers a workaround. Instead of relying on your fallopian tubes, doctors take eggs from your ovaries, fertilize them with sperm in a lab, and place the resulting embryo directly into your uterus. It’s a game-changer for women with tied tubes because it skips the blocked path entirely. Success rates are solid—around 40-50% per cycle for women under 35, though they drop with age. But here’s the catch: IVF isn’t cheap. A single cycle can cost $12,000 to $20,000, and many need more than one try.

So, naturally, you’re hoping insurance can lighten the load. Let’s explore what’s possible.

Does Insurance Cover IVF? The General Picture

Insurance coverage for IVF varies wildly. It depends on where you live, your employer, and the fine print of your plan. Only 21 states in the U.S. have laws requiring some form of infertility coverage as of March 2025. Even then, “infertility” and “IVF” don’t always mean the same thing to insurance companies.

Here’s a quick rundown:

- State Mandates: States like New York, New Jersey, and Illinois require large group plans (think companies with over 100 employees) to cover up to three IVF cycles. Rhode Island was a pioneer, even mandating coverage for fertility preservation if medical treatments might harm your fertility. But these laws often have limits—age caps, cycle maximums, or specific diagnoses.

- Employer Plans: Some big companies—like Google or Starbucks—offer fertility benefits, including IVF, as a perk. Smaller employers? Less likely.

- No Coverage: In states without mandates (hello, Florida and Texas), you’re often on your own unless your employer opts in.

Sounds promising, right? But here’s where tubal ligation throws a wrench into things.

The Tubal Ligation Twist: Why It Matters to Insurance

Tubal ligation is considered elective. You chose it (even if it felt like the right call at the time). To insurance companies, that’s a red flag. They often see IVF after tubal ligation as “fixing” a voluntary decision, not treating a medical condition. It’s like asking them to pay for a tummy tuck reversal—most plans won’t bite.

Why Insurers Say No

- “Not Medically Necessary”: Infertility is usually defined as failing to conceive after a year of trying (or six months if you’re over 35). If your tubes are tied, you’re not “trying” in the natural sense—so some insurers argue it doesn’t count.

- Pre-Existing Choice: Since tubal ligation was your decision, not a disease, they may classify IVF as an uncovered elective procedure.

- Policy Exclusions: Many plans explicitly exclude fertility treatments after sterilization. Check your handbook for phrases like “voluntary sterilization” or “reversal-related costs.”

When They Might Say Yes

It’s not all doom and gloom. There are exceptions:

- Medical Necessity Beyond Sterilization: If you have other fertility issues—like endometriosis or low egg count—some plans might cover IVF, even post-tubal ligation.

- State Laws: In mandate states, coverage might hinge on how “infertility” is defined. New Jersey, for example, covers IVF if you’ve tried other methods (like artificial insemination) and failed—tied tubes or not.

- Employer Generosity: Progressive companies might not care about your tubal ligation history if their plan includes IVF.

Real talk: Most women with tied tubes get stuck paying out of pocket. But don’t lose hope yet—there’s more to the story.

State Laws in 2025: What’s New?

State laws are evolving, and 2025 has brought some updates worth knowing. California’s new IVF mandate, effective July 2025, requires large group plans to cover three egg retrievals and unlimited embryo transfers. It’s a big win—but there’s a catch. If your tubal ligation is flagged as elective, insurers might still deny you. Meanwhile, Colorado expanded its infertility coverage to include single women and same-sex couples, which could set a precedent for broader definitions of “need.”

Trending discussions on platforms like X show people buzzing about these changes. One user posted, “Finally, some states are stepping up—but why does it still feel like a lottery?” That’s the vibe: progress is happening, but it’s uneven.

Interactive Quiz: Does Your State Cover IVF?

Take a sec to find out where you stand:

- Do you live in a mandate state (e.g., NY, NJ, CA, IL)?

- Yes → Keep reading; you might have a shot.

- No → Coverage is less likely, but check your plan.

- Does your plan mention infertility benefits?

- Yes → Look for sterilization exclusions.

- No → You’re probably paying cash.

- Had your tubal ligation for medical reasons (e.g., heavy bleeding)?

- Yes → You might argue it wasn’t fully elective.

- No → Tougher sell.

Score two or more “Yes” answers? Dig into your policy—it’s worth a shot.

Real Stories: What Women Are Experiencing

Let’s get personal. Meet Sarah, a 38-year-old from Ohio. After her second kid, she got a tubal ligation, thinking her family was complete. Five years later, remarried and ready for another, she turned to IVF. Her insurance? A flat no. “They said it was my choice to tie my tubes, so no coverage,” she shared. Out-of-pocket cost: $15,000 per cycle. She’s now on her second try, dipping into savings.

Then there’s Maria in New York. Same situation, different outcome. Her state’s mandate kicked in, and her employer’s plan covered two cycles. “I had to fight for it—tons of paperwork—but it worked,” she said. Her son was born last year.

These stories highlight the gap: location and persistence can make or break your chances.

How to Check Your Insurance: A Step-by-Step Guide

Feeling lost? Here’s how to figure out what your insurance will do:

- Grab Your Policy: Find your plan’s “Summary of Benefits” online or call your provider. Look for “infertility services” or “assisted reproductive technology.”

- Call Customer Service: Ask: “Does my plan cover IVF? What about after a tubal ligation?” Be ready for a vague answer—push for specifics.

- Talk to HR: If you’re insured through work, your HR rep might know about fertility perks.

- Consult a Fertility Clinic: Many offer free financial counseling. They’ll call your insurer for you and decode the jargon.

- Appeal if Denied: Denied claims aren’t final. Submit a letter explaining your case—mention medical necessity or state laws if they apply.

Pro Tip: Record calls and take notes. Insurance reps sometimes contradict each other.

What If Insurance Won’t Pay? Creative Solutions

If insurance gives you the cold shoulder, don’t despair. There are ways to make IVF more doable:

Financing Options

- Clinic Discounts: Some offer multi-cycle packages (e.g., $25,000 for three tries) or refunds if you don’t conceive.

- Loans: Companies like Future Family provide IVF loans with low interest—think $200/month payments.

- Grants: Nonprofits like Baby Quest Foundation award cash to cover treatment. Apply early; spots fill fast.

IVF vs. Tubal Reversal

Another option is reversing your tubal ligation surgically. It’s cheaper upfront—around $5,000 to $10,000—but insurance rarely covers it either. Success rates hover at 30-70%, depending on age and tube damage, versus IVF’s 40-50% per cycle. A 2015 study in Fertility and Sterility found reversal more cost-effective for women under 41, but IVF wins for speed and certainty.

Quick Comparison Table

| Option | Cost | Success Rate | Insurance Coverage? | Recovery Time |

|---|---|---|---|---|

| IVF | $12K-$20K | 40-50% | Sometimes | Minimal |

| Tubal Reversal | $5K-$10K | 30-70% | Rarely | 4-6 weeks |

Fresh Insights: 3 Things You Haven’t Heard Enough About

Most articles stop at “check your insurance” or “it depends.” Let’s go deeper with some under-discussed angles:

1. The Emotional Cost of Fighting for Coverage

Battling insurance isn’t just about money—it’s exhausting. A 2024 survey by Resolve: The National Infertility Association found 68% of women seeking IVF after sterilization felt “hopeless” during the process. One respondent said, “I spent hours on the phone, crying, just to hear ‘no’ again.” Tip: Lean on support groups (online or local) to vent and strategize.

2. Emerging Lawsuit Trends

Here’s something new: lawsuits are popping up against insurers who deny IVF after sterilization. In 2023, a New York woman won a case arguing her tubal ligation was medically necessary (due to severe endometriosis), not elective. Courts are starting to question rigid exclusions. Could this shift the tide? Keep an eye on legal news—it might inspire your own appeal.

3. Mini-IVF: A Lower-Cost Alternative

Ever heard of mini-IVF? It uses fewer drugs, cutting costs to $5,000-$7,000 per cycle. Success rates are slightly lower (30-40%), but it’s gentler on your body. Clinics like CNY Fertility swear by it for post-tubal patients. Why isn’t this talked about more? It’s less profitable for big centers, so it flies under the radar.

Your Action Plan: Making IVF Happen

Ready to take charge? Here’s your roadmap:

- Assess Your Situation: Age matters—IVF success drops after 35. If you’re over 40, mini-IVF or donor eggs might boost your odds.

- Dig Into Coverage: Use the steps above to confirm what’s covered. Don’t assume a “no” is final.

- Budget Smart: Save for one cycle while exploring grants or loans. Every dollar counts.

- Pick a Clinic: Look for ones with payment plans or high success rates for post-tubal cases (check SART.org for stats).

- Stay Hopeful: Stress hurts fertility. Meditate, journal, or chat with a friend who gets it.

Checklist: Are You Ready for IVF?

✔️ Confirmed insurance stance

✔️ Explored financing options

✔️ Found a supportive doctor

❌ Still feeling overwhelmed? Talk to someone who’s been there.

The Bigger Picture: Why This Matters

IVF after tubal ligation isn’t just about money—it’s about choice. You made a decision years ago, but that doesn’t mean your story’s over. Insurance companies might not see it that way, but you’re not powerless. Whether it’s fighting for coverage, finding a workaround, or celebrating a win, every step brings you closer to your goal.

Take Jenna, a 42-year-old from Texas. No state mandate, no employer help. She crowdfunded $18,000, did mini-IVF, and welcomed twins in 2024. “It was hard, but I’d do it again,” she said. Your journey might look different, but it’s yours to shape.

Final Thoughts: Your Next Move

Will insurance pay for IVF after tubal ligation? Maybe, maybe not. It’s a roll of the dice—state laws, plan rules, and a bit of luck all play a part. But here’s the truth: you’ve got options. From digging into your policy to exploring mini-IVF, there’s a path forward. Start with a phone call, a deep breath, and a belief that this could work.

What’s your plan? Drop a comment below—I’d love to hear where you’re at. Let’s keep this conversation going.